By Patrick Bond.

In early June, a University of Pretoria conference at the Governance Innovation Centre [2], keynoted by Indian eco-feminist Vandana Shiva, contemplated how to go “beyond GDP.” The current system of economic bean-counting is terribly inappropriate for a continent “rising” in rhetoric but, in reality, being looted at a breakneck pace.

As the Pretoria host, Prof. Lorenzo Fioramonti [3], author of the 2012 book Gross Domestic Problem, explained, “Gross Domestic Product focuses exclusively on market activities—that is, present income and production flow—whereas alternative measures of inclusive wealth highlight the importance of stocks of assets and their changes over time. The politics of GDP makes countries blind by rewarding short-term consumption and wholesale exploitation of natural assets at the expense of social justice and sustainability.”

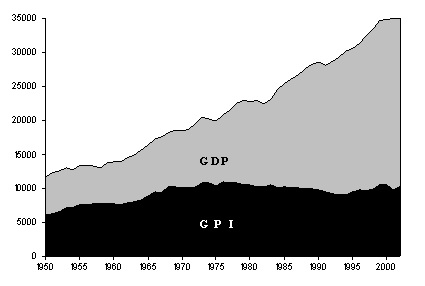

The head-in-sand, ostrich-mimicking economists and financial journalists who use GDP without correction probably aren’t even aware that the figure does not include resource depletion, unpaid women’s and community work, pollution, loss of farmland and wetlands, family breakdown and crime. There are many substitutes for GDP, and one—the Genuine Progress Indicator—shows a substantially lower level of world welfare, around $36 trillion using GDP compared to less than $10 trillion using GPI in 2005, once these corrections are made.

World corrections to Gross Domestic Product (GDP)

Source: Rethinking Progress

Africa is hardest hit by two of these corrections—resource depletion and white collar crime—so any fantasy of “Africa Rising” must be completely rethought once we recalculate. Regarding crime, as University of Massachusetts economist Leonce Ndikumana [4] has shown, more than US$1.7 trillion was looted from Africa through Illicit Financial Flows (IFF) not tracked through GDP from 1970-2010.

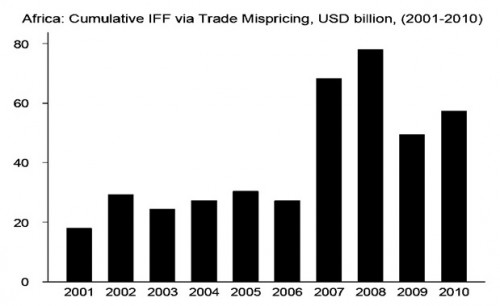

According to Simon Mevel, Siope Ofa and Stephen Karingi [5] from the UN Economic Commission on Africa, IFF includes “1) Corruption, which is the proceeds from theft and bribery by government officials; 2) Proceeds from criminal activities, including drug trading, racketeering, counterfeiting, contraband, and terrorist financing; 3) Proceeds from commercial tax evasion mainly through trade mispricing and laundered commercial transactions by MultiNational Corporations (MNCs).” As they concede, the problem is getting worse, with trade mispricing alone rising from less than $30 billion a year before 2006 to more than double that level in the subsequent four years.

Source: Simon Mevel, Siope Ofa and Stephen Karingi, United Nations Economic Commission for Africa

The NGO Global Financial Integrity [6] lists five African countries as having lost the most to IFFs during the period 1970-2008:

1 Nigeria $217.7 bn

2 Egypt $105.2 bn

3 South Africa $81.8 bn

4 Morocco $33.9 bn

5 Angola $29.5 bn

Here in South Africa, misinvoicing has become a major national controversy. Dr. Dick Forslund, a Swedish economist based at Cape Town’s Alternative Information and Development Centre [7], recently questioned how the big MNC mining houses could fail to get market-related prices during international platinum sales, which in turn meant they were underpaying their own books by at least $1.5 billion over the last decade.

The firms denied it, and as if on cue, African National Congress general secretary Gwede Mantashe [8] immediately launched a paranoid attack on Forslund, who was assisting the Association of Mineworkers and Construction Unions (AMCU): “The articulation of the AMCU position by white foreign nationals signals the interest of these foreign forces in the destabilisation of our economy.”

Mantashe did not mention ANC deputy president Cyril Ramaphosa [9], for many years a 9% shareholder and board member of Lonmin, the London firm once run by Tiny Rowland, who was “the unacceptable face of capitalism” according to then Tory prime minister Edward Heath [10] in 1973. Lonmin’s Marikana platinum operations became infamous in August 2012, because of what appears now as a pre-meditated massacre that took place the day after Ramaphosa sent emails to the police and mining minister upgrading a labour dispute to “dastardly criminal.” The police shot 34 dead, many execution style.

In the same spirit, Pretoria’s diamond valuators have winked and nodded while DeBeers apparently mispriced US$2.83 billion [11] from 2004-12, according to Africa Report columnists Sarah Bracking and Khadija Sharife.

These are just some of the reasons why in South Africa, the country that PricewaterhouseCoopers recently reported was the world’s worst for corporate fraud [12], “natural capital” should be carefully counted. Otherwise, the mining and oil MNCs will loot us blind.

More:

Article from TripleCrisis: http://triplecrisis.com/can-natural-capital-accounting-come-of-age-in-africa-part-1/

URLs in this post:

[1] Patrick Bond: http://triplecrisis.com/author/patrick-bond/

[2] Governance Innovation Centre: http://www.governanceinnovation.org/

[3] Lorenzo Fioramonti: http://www.premiumtimesng.com/opinion/140002-nigeria-vs-south-africa-in-flawed-gdp-battle-by-lorenzo-fioramonti.html

[4] Leonce Ndikumana: http://www.thetidenewsonline.com/2014/04/11/finance-experts-meet-to-end-capital-flight/

[5] Simon Mevel, Siope Ofa and Stephen Karingi: http://www.afdb.org/en/aec/papers/paper/quantifying-illicit-financial-flows-from-africa-through-trade-mis-pricing-and-assessing-their-incidence-on-african-economies-945/

[6] Global Financial Integrity: http://www.gfintegrity.org/issue/illicit-financial-flows/

[7] Alternative Information and Development Centre: http://aidc.org.za/programmes/political-economy/political-economic-debates/64-platinum-companies-are-under-selling-metals-aidc.html

[8] Gwede Mantashe: http://thenewage.co.za/127730-1009-53-Platinum_strike_political

[9] Cyril Ramaphosa: http://www.dailymaverick.co.za/article/2013-10-24-marikana-massacre-ramaphosas-statement-revisited/#.U5abbSjQ50c

[10] Edward Heath: http://en.wikipedia.org/wiki/Tiny_Rowland

[11] DeBeers apparently mispriced US$2.83 billion: http://thestudyofvalue.org/2014/05/15/new-lcsv-working-paper-explores

[12] world’s worst for corporate fraud: http://www.timeslive.co.za/thetimes/2014/02/19/world-fraud-champs

The project ENVJUSTICE has received funding from the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme (grant agreement No. 695446)